Disbursement adjustments are increases or decreases to the disbursement column in the ledger. These transactions are often correcting adjustments. A common example involves the entry of foreign funds. When you need to deposit funds, you enter the current exchange rate for the funds. However, when those funds actually post, the exchange rate may have changed slightly. An adjusting entry is used to balance the origin transaction.

Disbursement Increase

Increase – Funds Out (Debit Adjustment): The Disbursements column of Form 2 (which includes checks) will be increased, while the Ledger Balance will be decreased.

A disbursement increase may be used to reverse a disbursement decrease performed by mistake, or to adjust a correcting difference.

Note: A disbursement, by definition, is NEGATIVE, so you choose INCREASE to show money going OUT of the account.

Transfer Out

This type of transaction is rare and is used when showing a transfer out to a non-Stretto-preferred bank.

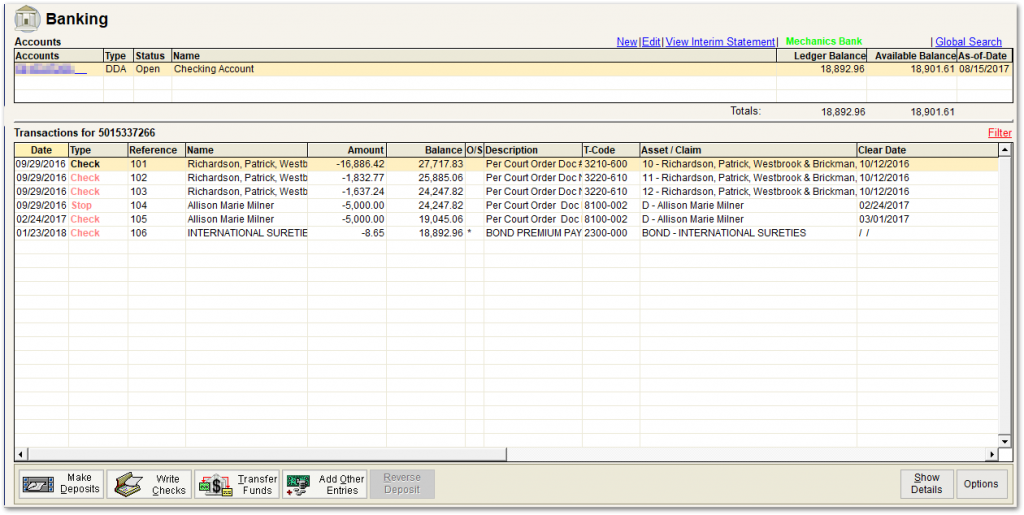

1. Click on the ‘Banking’ tab from the Form Selection toolbar on the far left side of the screen, which reveals the Banking screen (shown below).

2. Highlight (single click on) the account from the Ledger (Banking) screen grid for which you need to show a transfer exiting.

3. Click on the ‘Add Other Entries’ button. You will see the Select Entry Type window as shown below.

4. Click on the ‘Disbursements Column’ button and then on the ‘Increase’ button (it is selected by default).

5. Click on ‘OK’. You will see the Disb. Adj. screen, shown below. Fill in the details of the transfer to match with the bank’s transfer date and amount. Use ‘9999’ for the Category. No claim reference is needed.

6. Click on ‘Save’.

7. Next, you must show the money going INTO the other account (Deposit Adjustment).

Disbursement Decrease

This transaction type is frequently referred to as a “Negative Adjustment”. This happens when disbursed funds are returned from the creditor/payee.

Decrease – Funds In (Credit Adjustment): The Disbursements column of Form 2 (which includes checks) will be decreased, while the Ledger Balance will be increased.

You can also use a Disbursement Decrease to reverse a mistakenly entered Disbursement Increase.