Obtaining Tax Identification Numbers

1. When opening the first account in Trustee Suite, the user will be prompted to request an Insta-TIN.

2. Select the ‘Case’ tab from the Form Selection toolbar on the far left side of the screen, which reveals the Case Information screen, and then the ‘Debtor’ tab at the top of the screen, which offers an option to request a Debtor TIN and Co-Debtor TIN. Click on the ‘TIN / SS-4’ button.

3. A TIN can also be obtained directly from the Internal Revenue Service.

Trustee Suite will automatically update your Case Information screen with the application of your new TIN. Insta-TIN requests can be generated from the following areas in Trustee Suite:

- Users can request the TIN (both Debtor and Co-Debtor) via the ‘TIN / SS-4’ button on the Case screen.

- When a user opens a new account and no TIN is on file, they will be prompted if they would like an Insta-TIN. If there is a Co-Debtor for the case, the prompt will also include the secondary TIN in the request.

- When a Co-Debtor is added to the case and the Co-Debtor ‘TIN’ field is blank, but the Debtor has a TIN, they will be prompted if they would like to request a Co-Debtor TIN.

Note: Secondary TIN requests will be processed and added to Trustee Suite once the bank has a TIN for the Debtor on file. The bank requires secondary TINs to send a W-9. Trustee Suite’s e-sign feature handles secondary TIN requests.

Obtaining Electronic Tax Identification Numbers from Transmission

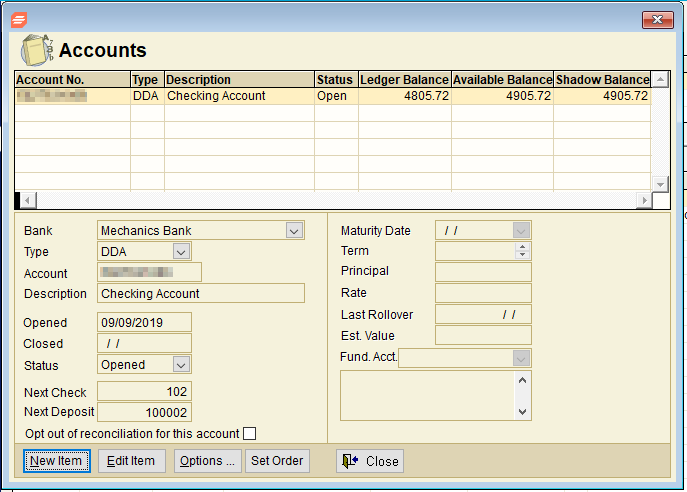

Users can electronically receive a TIN for a case directly through Trustee Suite. Select the case and click on the ‘Banking’ tab from the Form Selection toolbar on the far left side of the screen, then ‘Accounts’ from the Banking sub-menu beneath the tabs on the far left side of the screen. On the Accounts screen (shown below), click on the ‘New Item’ button at the bottom of the screen. Select the ‘Account Type’, then click on ‘Save’.

Users will automatically be prompted to request an Insta-TIN. Click on ‘Yes’ to approve your request. In the ‘Debtor’s’ tab, the status will reflect that the user has applied for the TIN.

Trustee Suite sends banking information to the bank throughout the day. TIN requests are included in the automatic transmissions. From the top Main Menu toolbar (File Menu), users can select ‘Bank Communications’ > ‘Bank Activity’ > ‘Items to Send’ to check the status of the item.

- The Home Page (under the ‘Banking’ section) will display the Electronic W-9s to be signed (in red).

- Use the ‘Sign All’ button to update, then click on ‘OK’.

After Transmission, the bank will process the request. The TIN will be applied for and you will receive confirmation of your TIN in your transmission log.

Check the ‘TIN’ field on the Case Information screen (shown in the first screenshot above under the ‘Debtor’ tab); it will change from “REQUESTED” to the TIN number.

Obtaining Tax I.D. Numbers from the IRS

When you obtain a TIN from the IRS, enter it in the Case Information screen (under the ‘Debtor’ tab in the first screenshot shown above) and submit a W-9 manually. Users must print and forward a paper W-9 to the bank and enter “Tin Applied For” on the form. Also, users should file an SS-4 with the IRS to request a Tax ID number. For more information on applying for a TIN with the IRS, go to www.irs.gov.